The dangers of selling goods on social media forums have been a theme in the media over the past few months prompted by incidents like Facebook Marketplace user Jess Kerr being bashed and cut with a knife while showing her car to a prospective buyer in a terrifying carjacking. Whilst some of the less extreme dangers have been explored, there is another which has surprisingly evaded publicity: PayPal eCheques. (Especially surprising considering that PayPal is a payment method that has actually been recommended by the ACCC.)

How the scam works

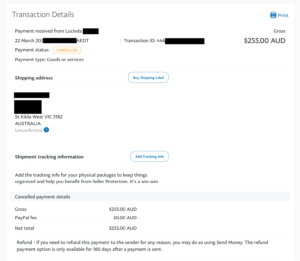

The scam works by the buyer (the scammer) initiating payment to the seller (the victim) using a PayPal eCheque. Once initiated, PayPal then sends the seller an email notifying them that “Your money is on the way” with transfer details, including the amount sent and the transaction ID.

In order for the scam to work, the seller simply has to assume that this notification from PayPal is as good as having the funds in your account (spoiler alert: it’s not). The seller then sends the goods but before the funds have actually cleared, the buyer contacts their bank and cancels the transaction. By doing this, they scam the seller out of their goods without incurring any cost.

While the PayPal notification does include a warning not to send any items before they have notified you that the eCheque has cleared, but it could easily be missed considering the length of the email. It is also quite small relative to the big-sized headline of “Your money is on the way”.

In the case we have been made aware of, a Facebook Marketplace sale in which the buyer requested the goods be sent to an address in the Melbourne suburb of St Kilda West, PayPal did not email the seller upon the cancellation of the eCheque by the buyer. In other words, it was up to the seller to discover that the eCheque had been cancelled; that they had been scammed.

Are you protected?

While PayPal does offer Seller Protection, it’s not clear whether any protection is available in the case of this eCheques scam. We emailed PayPal in Australia seeking clarification on this point but as at the time of publishing (over a month since we emailed), we are yet to receive a response.

What other avenues can you pursue?

Other than engaging with PayPal, you could also try reporting the incident via the following channels:

- Local Police: You could report the incident to your local police station or the police agency in your state or territory, providing them with all relevant information, including any communication, transaction details, and evidence you may have.

- ACORN: The Australian Cybercrime Online Reporting Network (ACORN) is a national initiative for reporting cybercrime incidents. You can report online scams through their website, and they will share the information with the appropriate law enforcement agencies.

- The relevant online marketplace: If the scam occurred on a specific online marketplace, you should also report the incident to the platform’s support or customer service. In this case it would be Facebook Marketplace. Buyers can be reported here.

In reality, while reporting the incident to any of the above channels might contribute to making online marketplaces safer in the long run, there’s a strong chance you won’t see your money or goods returned. The best first line of defence therefore is being diligent and keeping up to date with common scams.